Award-winning PDF software

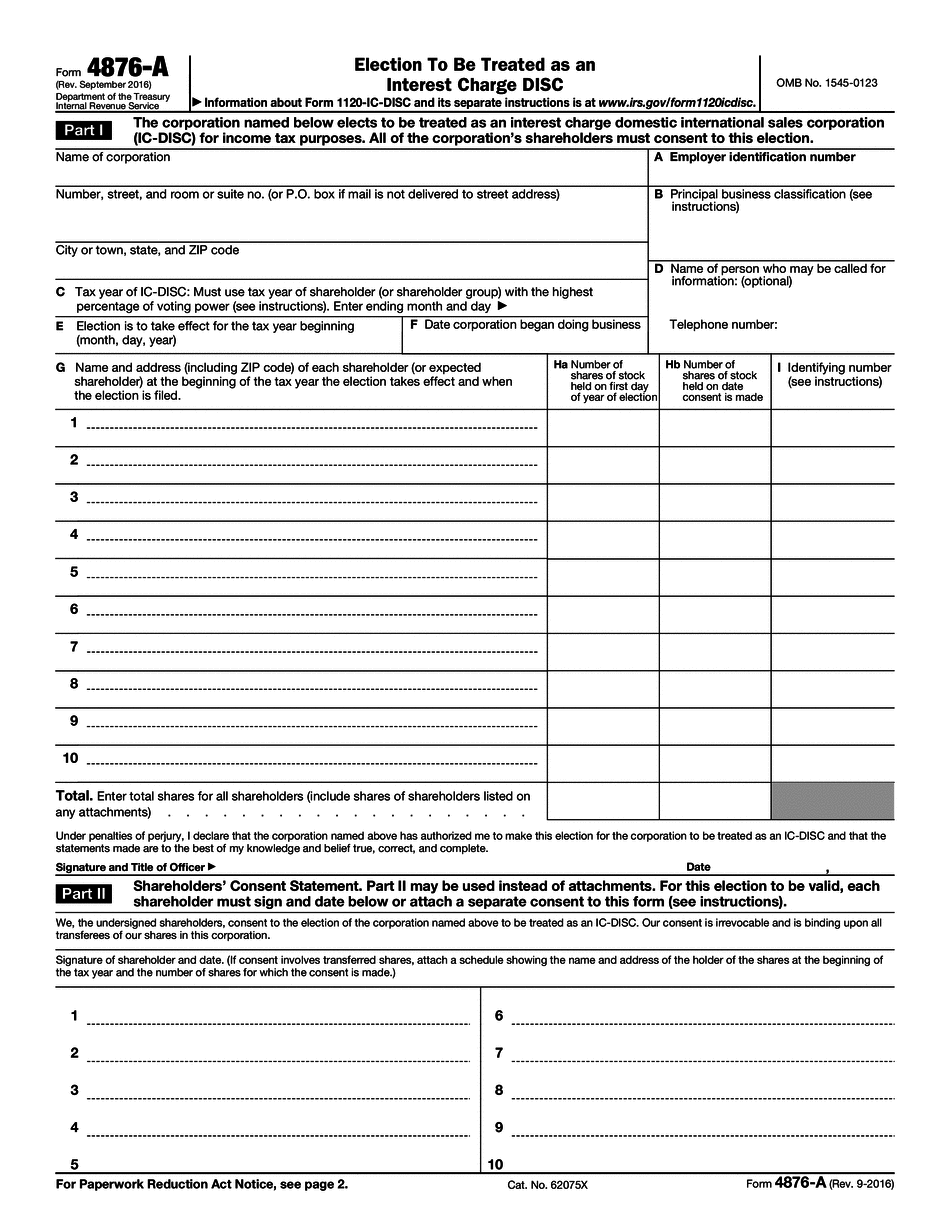

California online Form 4876-A: What You Should Know

You can file forms online or by mail. You do not submit paper work to the California State Board of Equalization (BOE). 2. Online Fee Payment — Filing fee payments can be done online. Online payments are accepted up to 45 days prior to January 25th for the tax year in question and up to 60 days prior to January 13th for the tax year following in any year. When using eFile.com, enter your payment information in the “Pay Online” box for the business entity, and provide an internet-based URL to submit the Form 8859 or the IRS Form 433 (Form 1120-T) to the California State Taxpayer Assistance Center. 3. Mail-In Form — A self-addressed stamped envelope will be mailed for payment. 4. Mail your payment to the following office address. California Secretary of State Business Entity Payment Center ATTN : California Business Entity Payment Address PO Box 124794 Sacramento, CA 94 5. The State Board of Equalization's electronic filing database accepts Form 4876-A and Form 1120-T as a secure record of payment. 6. Your payment may take up to 6 weeks to process. 7. If your payment does not clear and the fee is not paid within 3 months, the fee shall add and any penalties shall be added. 8. Fees will be withheld from your payment. Your receipt will indicate the amount withheld. 9. A 1099-MISC Notice and Notice of Ineligible Use will be sent to you by mail if you use an ineligible service or payment method during your filing year, or before you file your return for a return period longer than 3 months. This notice, also will be sent to any other business entity filing on behalf of you. F. If you have not paid federal or state federal income taxes in the last 13 months or have not received your payment on time, file a Federal Tax lien. If the IRS finds that you may qualify as a federal tax delinquency, either you must pay some delinquent tax (typically 20% to 35%) or you submit an IRS Form 6251, Federal Tax Lien, to the IRS. 10. If you are a California business entity, the IRS has developed a new application (Form 5637-B) to help you obtain an electronic Business Transaction Code (BTC) for your domestic international sales corporation (IC-DISC) using your California address. This form is available from the Business Transactions Desk at the IRS.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete California online Form 4876-A, keep away from glitches and furnish it inside a timely method:

How to complete a California online Form 4876-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your California online Form 4876-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your California online Form 4876-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.