Award-winning PDF software

ID Form 4876-A: What You Should Know

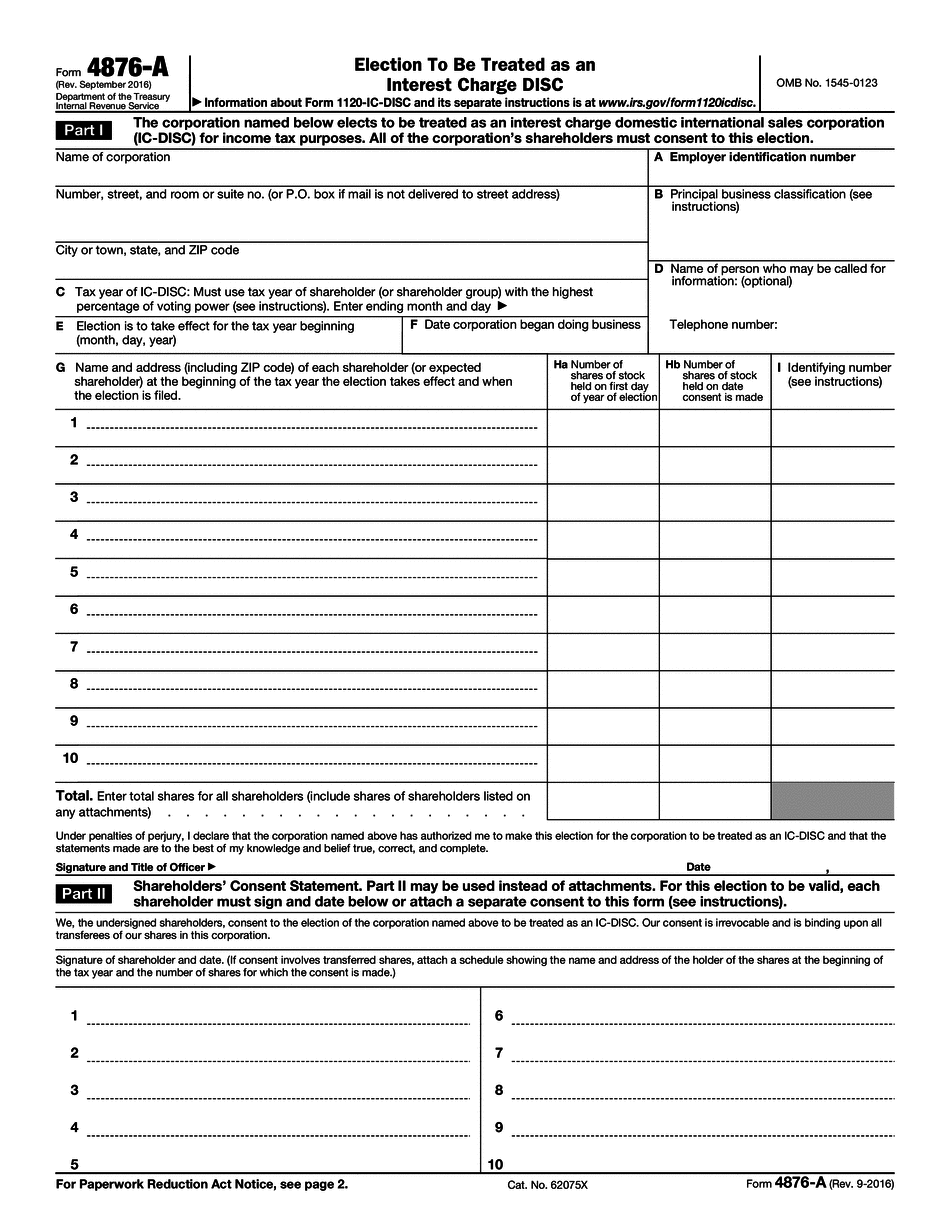

Form 4876-A must be signed by the president, vice president, treasurer, Assistant Treasurer The employer identification number, Form 8863 (Form 8863-T) is the Form 8863-T with the following modifications: The Form 8863-T number has 2 letters. The first letter is the first eight digits of the last 2 digits of the last 3 letters of the social security number The second letter is the last 6 digits of the social tax identification number of the business enterprise. Note that for purposes of disallowance of gain, the business enterprise shall not have reported the amount to which gain is disallowed prior to August 1st of the year in which the election would apply. Form 4876-A Fill Online, Printable, Fillable, Blank Form 4876-A (Rev. September 2016) — IRS Form 8863-A — Election to be treated as DISC for federal taxable years beginning after December 31, 2015. The form shall be signed by any person authorized to sign a corporation return under section 6062. Form 8863, Election to be treated as DISC for federal taxable years beginning after December 31, 2015. 26 CFR 1.992 — Election to be treated as a DISC. Fill in your information and request the forms. Send the forms to the above address using a readdressed, stamped business or personal stamped envelope or letter. Make sure to send in the following forms before May 15, 2017. The form must be completed completely. This form tells you whether your corporation will be treated as a DISC or non-DISC for federal taxable years ending after that date. The election will not change if the corporation is already treated as non-DISC. When you fill out this form, you know whether your corporation is eligible to be treated as either a DISC or non-DISC for federal state taxable years beginning after December 31, 2015. Form 8863-A (Rev. September 2016) — IRS Form 4876-A (Rev. September 2016) — IRS Form 8860-C Disallowance of Certain Other Dispositions or Qualify For Certain Refunds. The form allows your corporation to claim a deduction for disallowed itemization deductions that you can take to offset a loss. The form allows such deductions only with respect to losses or to make refunds.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete ID Form 4876-A, keep away from glitches and furnish it inside a timely method:

How to complete a ID Form 4876-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your ID Form 4876-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your ID Form 4876-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.