Award-winning PDF software

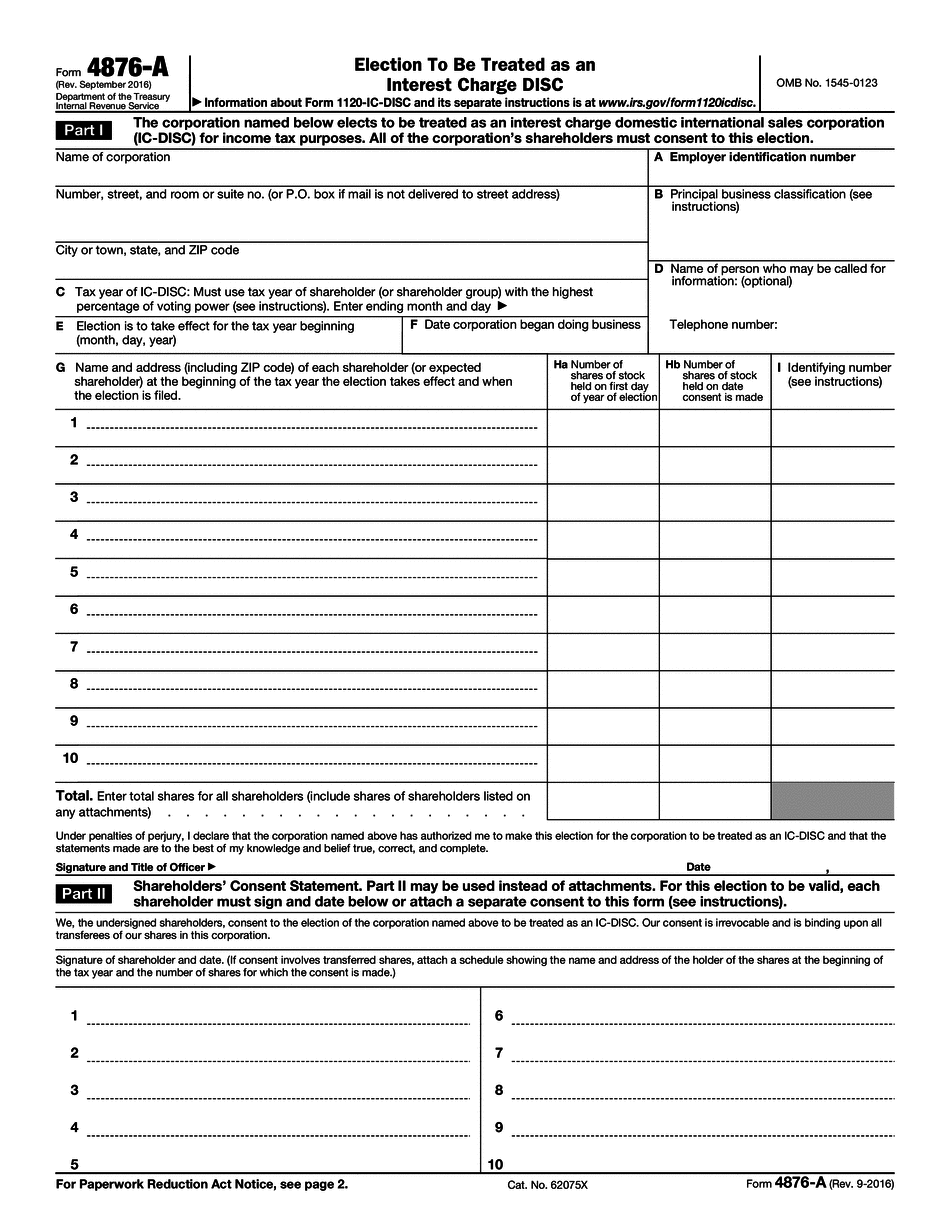

Printable Form 4876-A Clark Nevada: What You Should Know

Download Form Index, the comprehensive list of Nevada forms, from the website of the Legal Services Corporation of Clark County, Nevada. The Nevada Real Property Transfer Tax (PTT)7 includes forms for: Homesteads; Real Property Transfer Tax; Transfer of title for agricultural products through county clerks; transfer of title for livestock; transfer of title for personal property and real estate, including transfers pursuant to certain federal laws, such as the National Firearms Act and the Civil Rights Act of 1964; and the transfer of title for vehicles; property subject to the estate tax; and the transfer of the transferor's real property (real property located within the county). Eligibility for the PTT7 forms is determined by an affidavit signed or certified within six months before the date of transfer of title made or in connection with any transaction in which the transferor is a nonresident of Nevada or any other state with which Nevada does not enter into interstate real estate transactions. Eligibility for the Nevada Homestead (Nev. Rev. Stat. Ann. §§ 10-102 et seq.) has been modified from that for transfer under the Homestead Exemption Act (Nev. Rev. Stat. Ann. § 10-115). Homestead Exemption Act The original legislation, passed into law after the Great Depression, provided a full tax exemption for the value of a resident's primary residence for property and improvements placed in the same ownership class as the property in existence at the time the exemption was granted. The act gave the exemption to all property with a valuation of between 40,000 and 20,000 but restricted the exemption to those with the property in existence as of January 1 of the year before the valuation date. The act also permitted homesteads in Nevada to be transferred to other individuals, or to other families or communities, provided that the property subject of the transfer is worth at least two-thirds of the appraised value of the residence. The law is still in force with some minor modifications. For example, under current law, there is no requirement for an individual to own or be occupying a primary residence in order to qualify for the exemption. For more information visit the Nevada Law Library and the Nevada Real Estate Transfer Tax Guide Nevada Homestead (Nev. Rev. Stat. Ann. §§ 10-102 et seq.) The full exemption for Nevada property owners was changed in the 2025 legislative session.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 4876-A Clark Nevada, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 4876-A Clark Nevada?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 4876-A Clark Nevada aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 4876-A Clark Nevada from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.