Award-winning PDF software

Printable Form 4876-A Fulton Georgia: What You Should Know

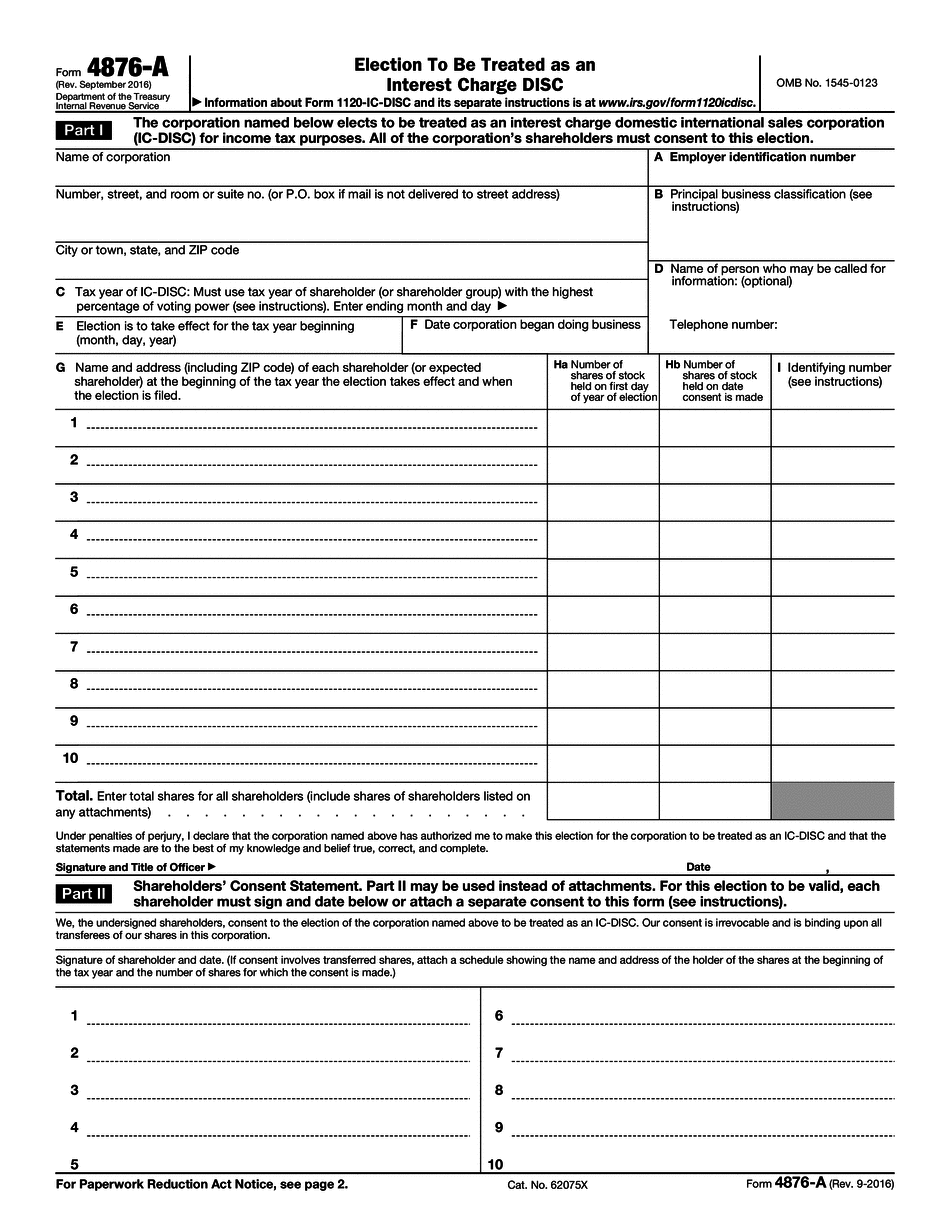

Form 4876-A (2) You have to file with us the following information: Form 2016 If you wish to be treated as an interest charge domestic international sales corporation (IC-DISC), you must file Form 2016, Election to Be Treated as an Interest Charge Domestic International Sales Corporation. [Note: You do not have to follow this form.] The form should include the following information on page three. If you are applying to be treated as an interest charge domestic international sales corporation (IC-DISC), you must file Form 2016, Election to Be Treated as an Interest Charge Domestic International Sales Corporation. Enter your information. Form 4876-A can be a lot of work. You can shorten your tax filing time with our downloadable Tax Worksheet PDFs. Download all 9 pages of the Tax Worksheet for form 4876-A Form 4876-B Form 4876-B (Rev. April 2015) Form 4876-B(2) does not require any information from the individual, a corporation, a partnership, a limited liability company or other business entity it applies to. Rather, it allows the individual to claim an interest under Schedule C, Part I of the Form 1040 tax return. This form provides a simple deduction for interest cost paid or accrued on foreign debt. It also has a special application to a special category of taxpayers: U.S. citizens. Interest charged on foreign debt is now generally deductible as a business expense. If your foreign income is under 10,000, or if you are a resident of the foreign country that issued the debt you are claiming interest and want to deduct that expense, you must either: File a separate form for the U.S. deduction. Or Sign Form 8283. Also note that if you are eligible to deduct interest under certain circumstances, and you also file Form 8283, you can claim the interest as a deduction at any time. If you have a credit card that includes a clause allowing you to deduct interest on the balance, but you don't want to deduct the interest in signing Form 8283, you should be able to make up for the deficiency by using a special Form 4876-B, Election to Be Treated as an Interest Charge Domestic International Sales Corporation that lets the credit card issuer deduct the interest on your behalf because it has approved the election.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 4876-A Fulton Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 4876-A Fulton Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 4876-A Fulton Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 4876-A Fulton Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.