Award-winning PDF software

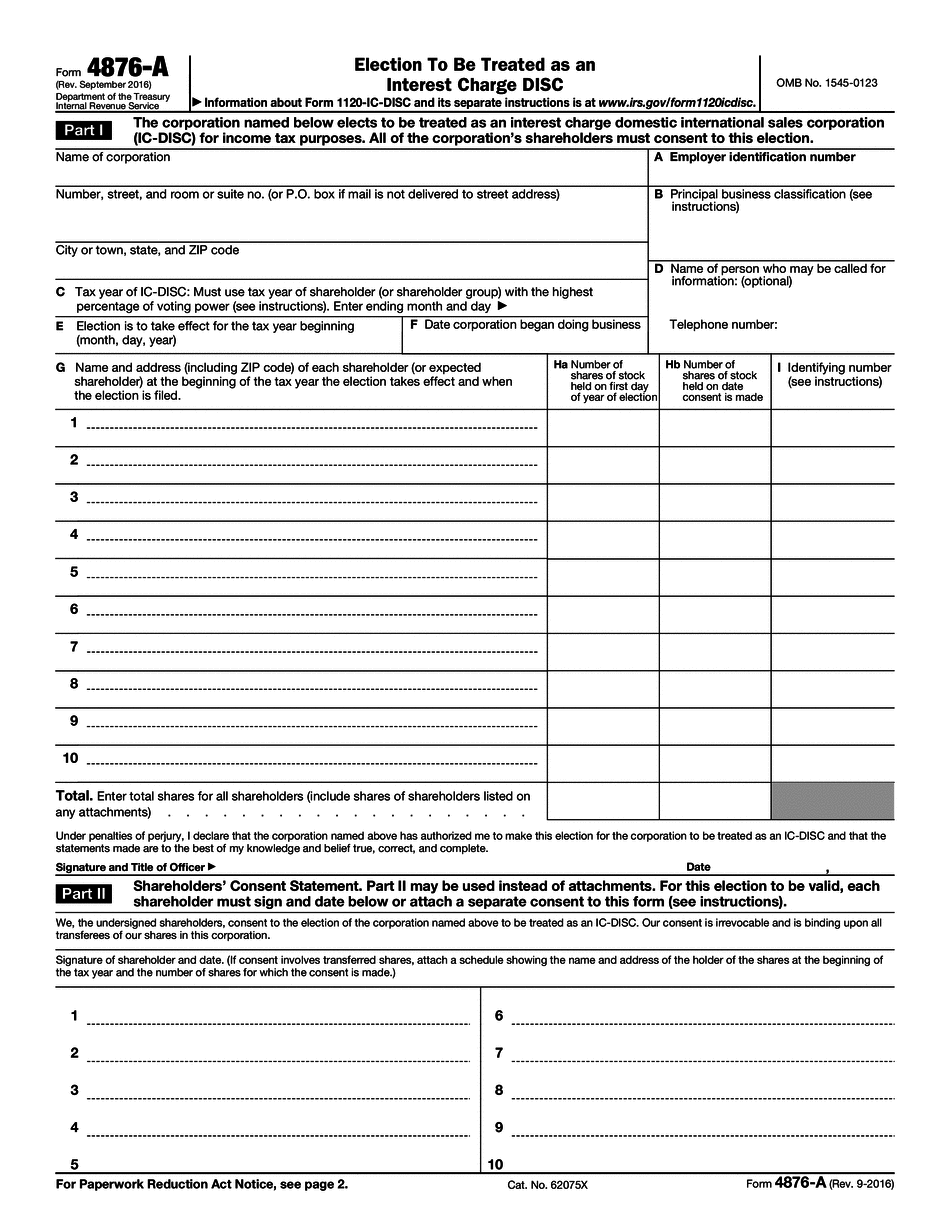

South Dakota Form 4876-A: What You Should Know

Congress to the following standards (Etta): (2) A statement of the current market value of the property in all of its elements and the current adjusted basis in all of its elements, including the goodwill from its sale, after all reductions for property sold by way of exchange, gift, and inheritance. (3) A statement of income, gain, loss, deduction, and credit earned, receivable, distributed, and outstanding, including-- If you like the look of this form, but prefer the ease of the paper business form, download and print it here. A New Tax Solution for Small-Establishing Businesses, from South Dakota Gov. Mike Rounds. This bill eliminates the double tax burden on small businesses by requiring shareholders to include all of a corporation's property in its gross income at the corporate level. The tax savings are substantial and this legislation provides a new business model for small businesses. The tax savings will help ensure that any business owner is able to take advantage of the best incentives and strategies to invest a low-cost business. The legislation will: Provide clarity for all businesses. Under the current tax code, businesses with only one owner pay their own business taxes. This creates confusion for some businesses, and it does not provide all businesses with clear guidance. The legislation will correct this problem through simplified tax rules that eliminate the complexities of the tax code for most small businesses. Eliminate double taxation by lowering the tax rate for small businesses. As written, the bill will increase taxes for businesses with just one shareholder. The legislation provides tax cuts for businesses with multiple shareholders by reducing the corporate income tax rate for businesses with multiple shareholders to five percent from the current rate of 21 percent. Business deductions will be allowed on the first 100,000 in gross annual cash wages, which is a tax break that is currently not available to those businesses. The legislation also provides a deduction of up to 500,000 of the first 2 million in gross annual cash wages. Ensure tax code provisions are simple, easy to comply with, and transparent, without causing undue complexity or unnecessary tax complexity. The legislation simplifies tax provisionation for small businesses by: Eliminating deductions to the first 100,000 in gross annual cash wages and exempting those amounts from income taxes. The amount of this break is based on three elements: 1.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete South Dakota Form 4876-A, keep away from glitches and furnish it inside a timely method:

How to complete a South Dakota Form 4876-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your South Dakota Form 4876-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your South Dakota Form 4876-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.