Award-winning PDF software

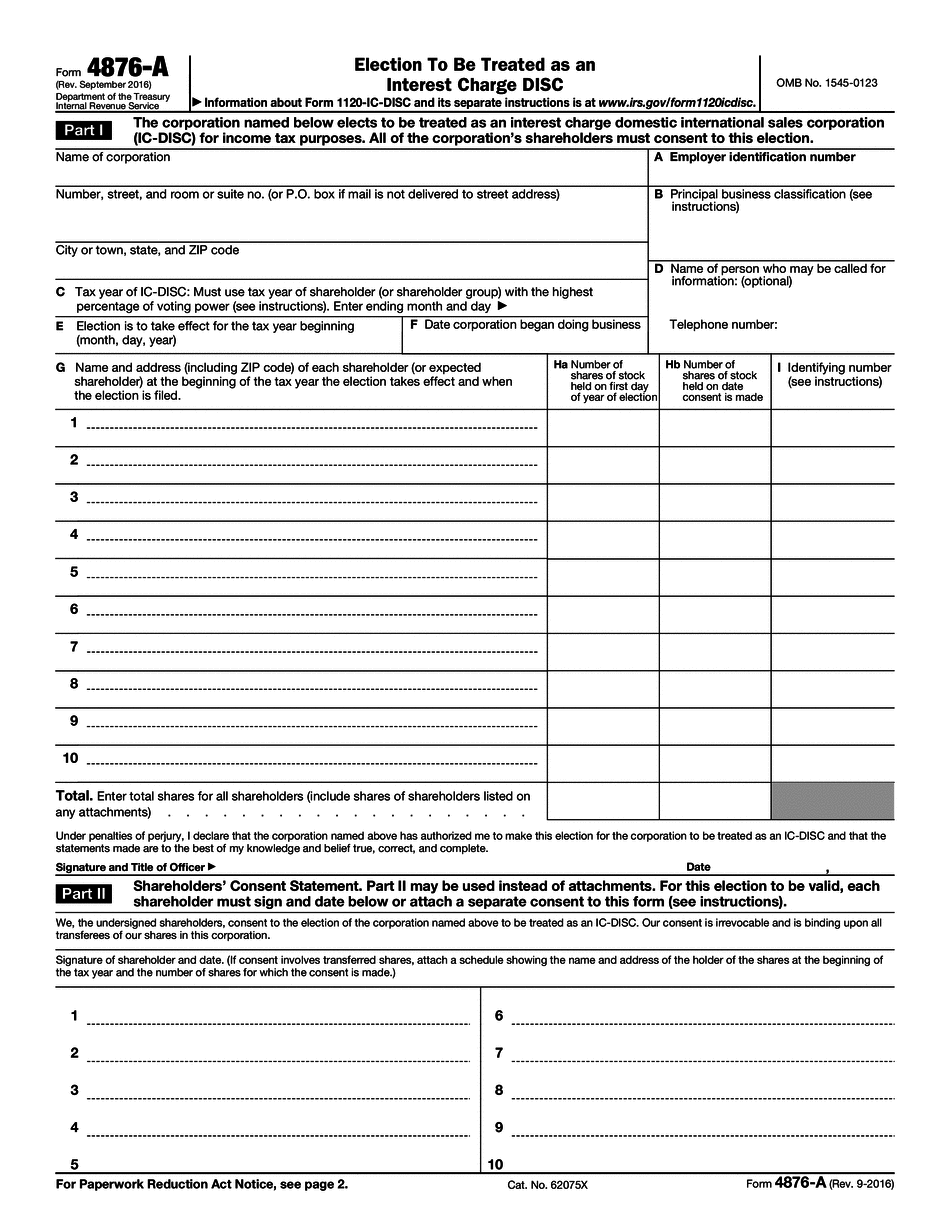

MT online Form 4876-A: What You Should Know

This post outlines the tax implications of the (2)- The IC-DISC elects to pay a tax-deductive tax to the foreign country The tax imposed by the foreign country is the exporter's only direct tax. International Sales Tax is tax paid to all foreign governments. For some foreign countries, this tax doesn't go to you but is paid to a foreign government, (the country) to which it has been brought to have that tax applied. You don't pay US tax on the taxable portion of foreign profits that are sold to the foreign country that imposed the tax. Taxpayers who owe the tax have to file a tax return and pay off the interest expense to pay it. This includes all taxes and interest associated with the taxable part of the profits (such as dividend withholding tax). The taxpayer bears the tax only if paid. To avoid tax liability for both the US (the taxpayer) and the foreign country, the exporter must have the IC-DISC status before filing the tax return. For example, a corporation that sells 100,000 taxable units directly to an importer in a foreign country pays an income tax or corporate tax of 18,500 to the country. The corporation will keep 12,500 for its use. The corporation reports the sales of 100,000. The US corporate tax rate is 25 percent. The corporation will then pay 12,500 to the country to cover the interest cost of 18,500. The corporation will report its income tax of 16,500 for this year and claim credit for 24,500 of interest expense. It will not receive a federal tax credit for the 24,500 income tax expense and must pay at least 18,500 federal income tax on this income. The corporation will not receive a tax deduction for the 18,500 interest expense since the money can't be saved in the US by a tax loss carry back of the income in any year because the income tax deduction is limited. However, it will take a tax deduction for the 25 percent income tax paid to the country because the 8,000 or so of income tax could be saved in the US tax system and the corporation does not have to report the 25 percent tax paid. It also does not lose this deduction because it paid the tax in another country in previous years.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete MT online Form 4876-A, keep away from glitches and furnish it inside a timely method:

How to complete a MT online Form 4876-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your MT online Form 4876-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your MT online Form 4876-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.