Award-winning PDF software

Form 4876-A online Connecticut: What You Should Know

In the Online Processing portal, a motor vehicle dealership collects sales taxes and updates its records to comply with the requirements of Connecticut's sales tax laws. Connecticut State Motor Vehicle Dealerships — Connecticut Online Dealer Registration Form — CT.gov This forms online dealership program provides vehicles for sale or lease to Connecticut consumers for purposes of determining whether a motor vehicle dealership, in connection with a retail sale or lease, is a retailer as defined in the Connecticut General Statutes, Part I, Item 1-B. The dealer shall comply with all the requirements set forth in State and local laws on the collection of the sales or use tax. . . . Connecticut sales tax forms for retailers or service stations are collected and prepared according to Connecticut's regulations. There are no exceptions for motor vehicle dealers Connecticut sales tax forms for dealers are collected and prepared according to Connecticut's regulations. There are no exceptions for retailers. Connecticut sales tax forms for dealers have to follow state and state/local regulations Connecticut sales tax forms for retailers or service stations are collected and prepared according to Connecticut's regulations. There are no exceptions for dealers. Motor Vehicle Dealerships — Online Processing — CT.gov Connecticut resident motor vehicle dealerships that register vehicles through internet auction sites like eBay, Groupon and other such vehicles are required to collect sales and use taxes on behalf of the sellers on a regular basis and to remit those taxes and information to the Connecticut Department of Motor Vehicles (DMV). This is the online dealer registration form used by dealerships and online auction companies for the same purpose. Connecticut sales tax forms online: Connecticut residents can find the form in the “Online Forms” tab: Conducting an in-depth search can be quite time-consuming due to the abundance of regulations and forms. Conducting an in-depth search has been proven to result in very little information. The IRS also requires a complex series of steps. Conducting an in-depth search results in some, but not all, information being uncovered and available. An in-depth search that focuses on how to process the forms, and how to determine if a tax return is legitimate or not, will result in some very valuable information being discovered in the process.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4876-A online Connecticut, keep away from glitches and furnish it inside a timely method:

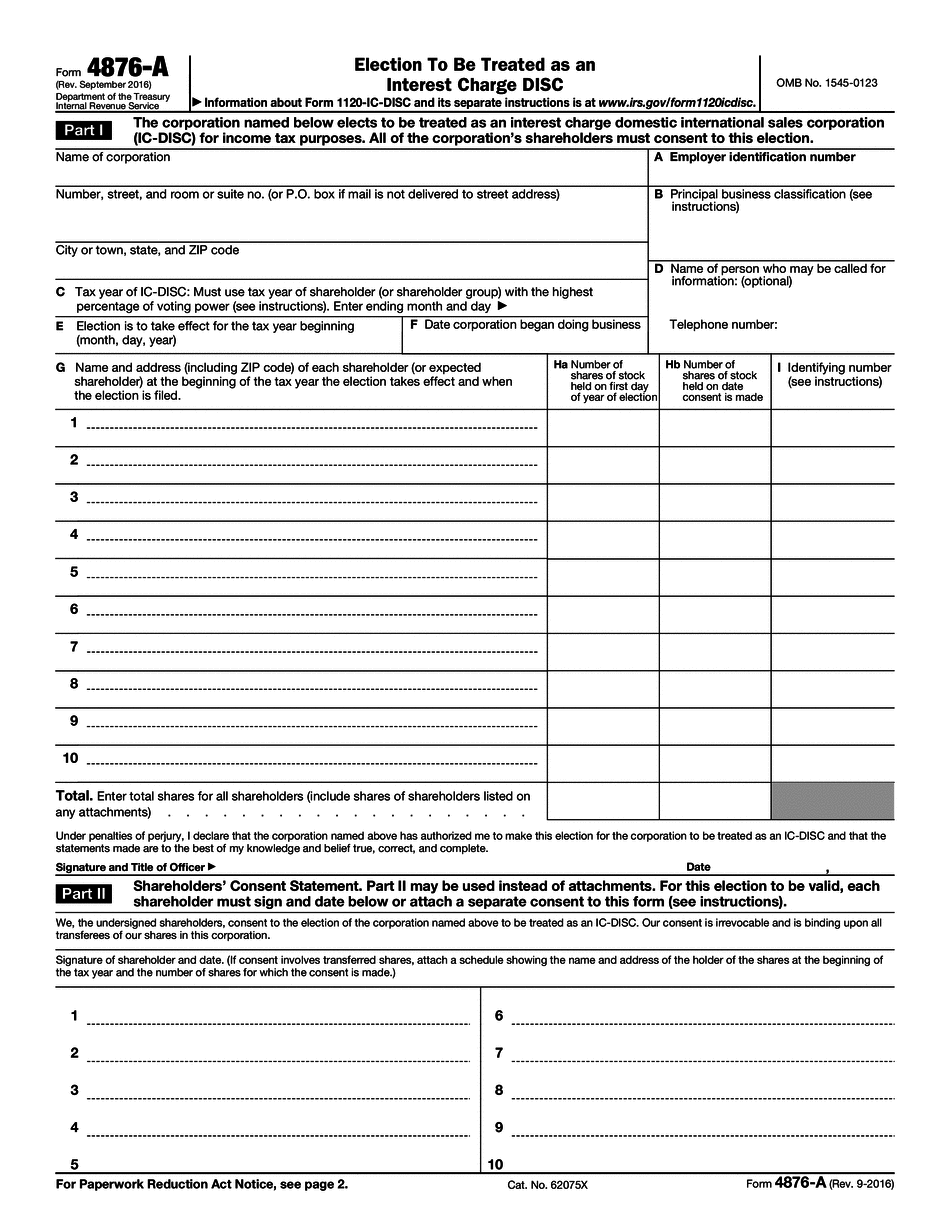

How to complete a Form 4876-A online Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4876-A online Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4876-A online Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.