Award-winning PDF software

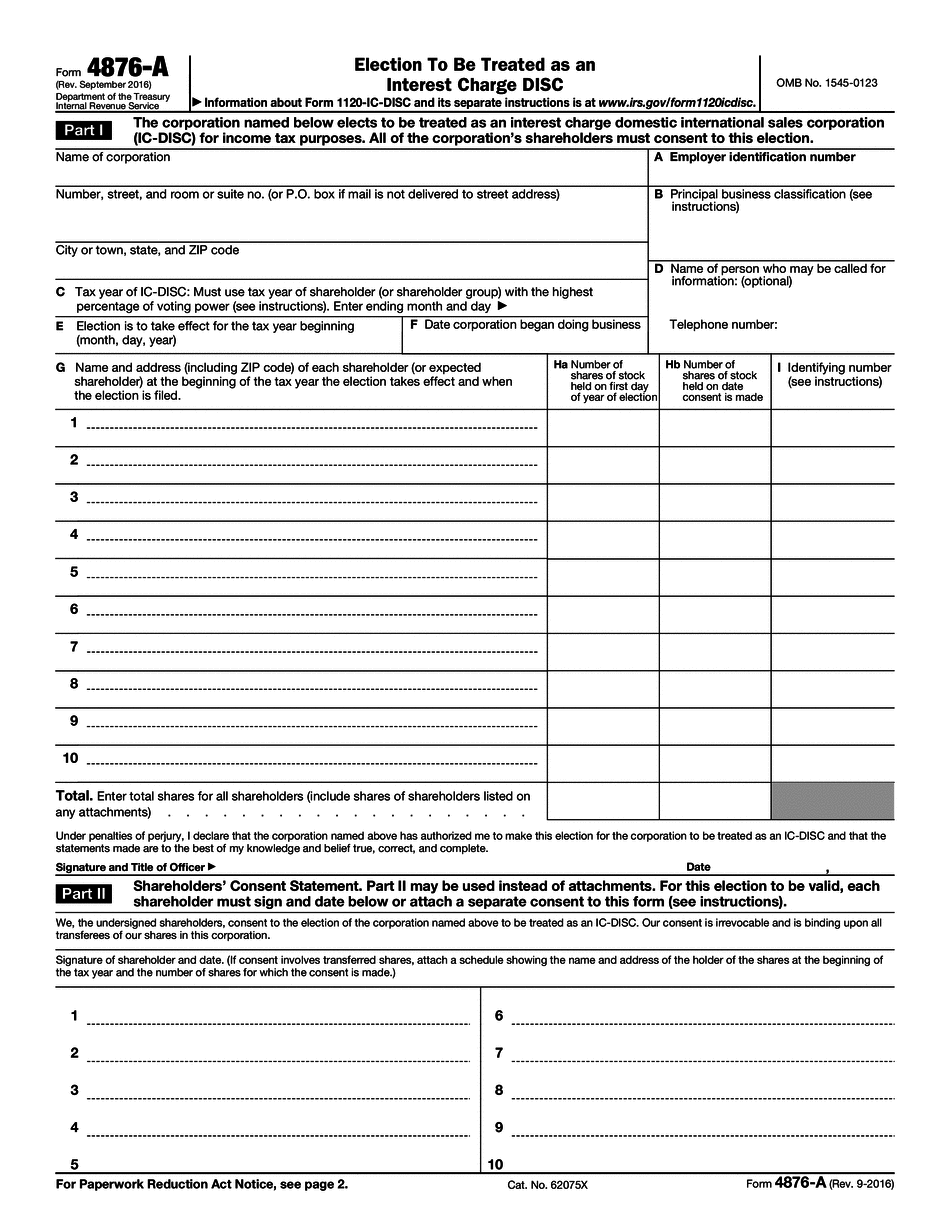

AK Form 4876-A: What You Should Know

Using either online fillable instructions or the paper Form 4876-A. Eligibility: Form 4876-A is not intended for an election to be treated as an investment trust. The following requirements must be met before the election is made: The person who has an absolute or qualified interest in the taxable year in which the election is made must be an individual (individual with respect to whom § 301.11 refers to a “specified individual” (i.e., a trust or estate of a qualified individual)). The corporate election must be made with respect to an interest held by the corporation or any of its subsidiaries. Elections are made for taxable years beginning after August 15, 2015, and are generally accepted by September 30, 2015. A corporation may select the “automatic election” method if filing its required Form 4876 by October 31, 2015. In this case, the election will be completed by filing Schedule M (Form 1023) with Schedule M–A (Form 1040), Schedule M–P (Form 1040), or Schedule M–Q (Form 1040) with Schedule M–E (Form 1040EZ) if required. The election cannot be made on the correct form. Any form required with respect to foreign interests should be completed and filed before any Form 4876 is submitted. Elections must be made for taxable years beginning after August 15, 2015, and are generally accepted by September 30, 2017. Determine if you are qualified to make an election: To make the election, you must meet either of the following tests. First, the corporation: Must be a corporation (or a closely held partnership, trust or association) that is (or has been at any time during the period that is the qualification year) a “controlled foreign corporation” (as defined in Regulations section 301.7701); or Is a foreign private investment company that (other than through a direct or indirect wholly owned subsidiary). Second, the person who has an absolute or qualified interest in the taxable year in which the election is made must: Be at least the minimum age for making an election under Part 1 of subpart F or Part II of subpart I of section 469A (age 19, if married or a surviving spouse of a taxpayer who is at least 55 years of age). Be a United States national and meet the physical presence test.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete AK Form 4876-A, keep away from glitches and furnish it inside a timely method:

How to complete a AK Form 4876-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your AK Form 4876-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your AK Form 4876-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.