Award-winning PDF software

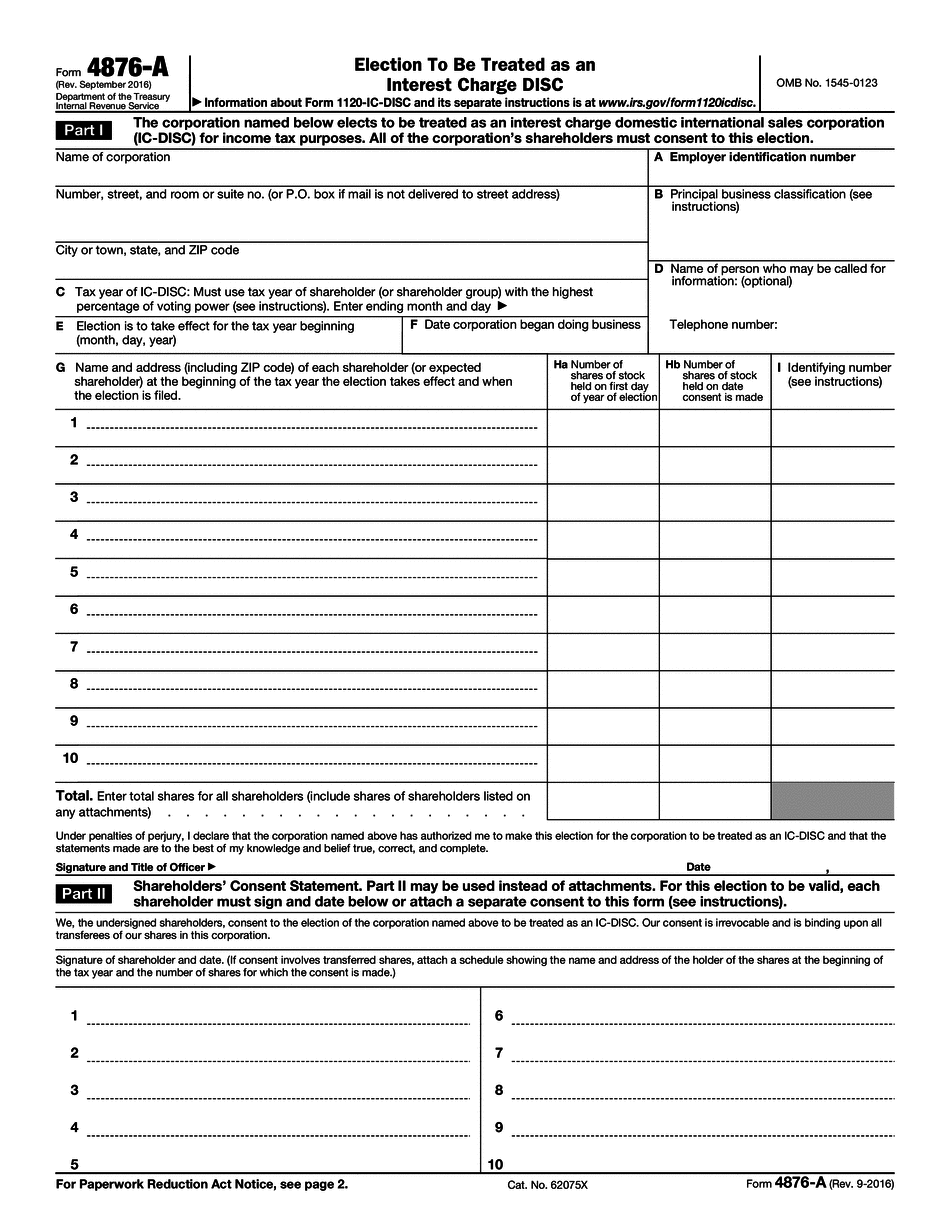

Los Angeles California Form 4876-A: What You Should Know

B)(1)(ii): What is an interest in (a) a foreign corporation that does not have a physical presence in the United States; and (b) a foreign corporation that is not a domestic corporation? An interest in (a) a foreign corporation that does not have a physical presence in the United States is a right to receive the annual income of the foreign corporation upon the death of the stockholder of that corporation, by virtue of the provisions of section 897 of title 18, United States Code, that provides that the stockholder of a domestic corporation has the right to receive income for his or her life, and that stockholders of foreign corporations, and corporations that are subject to the requirements of section 897, are entitled similarly to receive income for their lives. An interest in a foreign corporation that is not a domestic corporation is the right to receive income for the life (and tax year that begins after the stockholder dies in that case) of the corporation, by virtue of the provisions of section 904 of title 18, United States Code (tax year beginning on the day of the stockholder's death) that provides that all dividends and interest of a foreign corporation paid or accrued to a stockholder of that corporation on behalf of a domestic corporation (other than a dividend or interest in respect of which section 483(d)(4) applies) are exempt from taxation as to the stockholder solely by reason of his or her being a stockholder of the domestic corporation. Interest in a foreign corporation that is not a domestic corporation does not include a right to receive any payment directly and personally made by the corporation to any stockholder of that corporation. 26 CFR § 1.992-2 (b)(2): What is a foreign corporation? A foreign corporation is a corporation any of whose substantial activities are transacted outside the United States. 26 CFR § 1.992-2 (a): What are the circumstances under which a corporation will be treated as a domestic corporation if it is controlled by a controlled foreign corporation? For purposes of determining whether a corporation is a domestic corporation, a controlled foreign corporation that is a U.S. corporation is treated as a domestic corporation even if its assets are located within the United States.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Los Angeles California Form 4876-A, keep away from glitches and furnish it inside a timely method:

How to complete a Los Angeles California Form 4876-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Los Angeles California Form 4876-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Los Angeles California Form 4876-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.