Award-winning PDF software

Form 4876-A Texas Collin: What You Should Know

A recent American Action Forum report found that nearly half of the identity theft victims surveyed reported paying 600 or more to creditors for the damage. There have been many cases of identity theft where one spouse fraudulently uses the other's name and Social Security or credit card information, for non-bankruptcy purposes, without the other spouse's consent to get money from a joint account. This form of fraud, sometimes called “credit card billing fraud,” is on the rise across the nation. When someone steals your identity, they can: • Add fraudulent credit card charges or use of those payments to create a new account or for another purpose. • Use a stolen credit card number, bank account information, ATM or debit card numbers, or personal personnel records stolen during a burglary to authorize non-bank payments. • Get you to pay for something you didn't ask for. • Have you transfer money or use a credit card number to open a new account or to buy something you didn't want to. • Get a job you didn't ask for. • Pay your utilities or mortgage, even if you don't have any money or credit for your rent, food, and bills, and if you don't need the money. If your name, Social Security number, or birthdate was stolen to commit fraud, consider these facts during the tax preparer's income tax return preparation: • If you don't pay your bill in full, the IRS may send you an overpayment notice. This notice gives the person who has the stolen information to collect the balance. • Be sure to monitor your credit reports and credit card statements frequently. • If your taxes become delinquent, the IRS may file a civil, criminal, or administrative tax case against you. For more information, contact the FBI, National Credit Union Administration, or the Internal Revenue Service. If you don't believe a fraud occurred, and you want to file a claim for a tax credit, you can contact your state Attorney General. Each state has its own laws and procedures for filing a claim. Contact the office of your state Attorney General. Learn how to file a claim here: How to File a Report for a Federal Tax Credit Claim CERTIFICATION REQUIRED TO FILE RETURN.

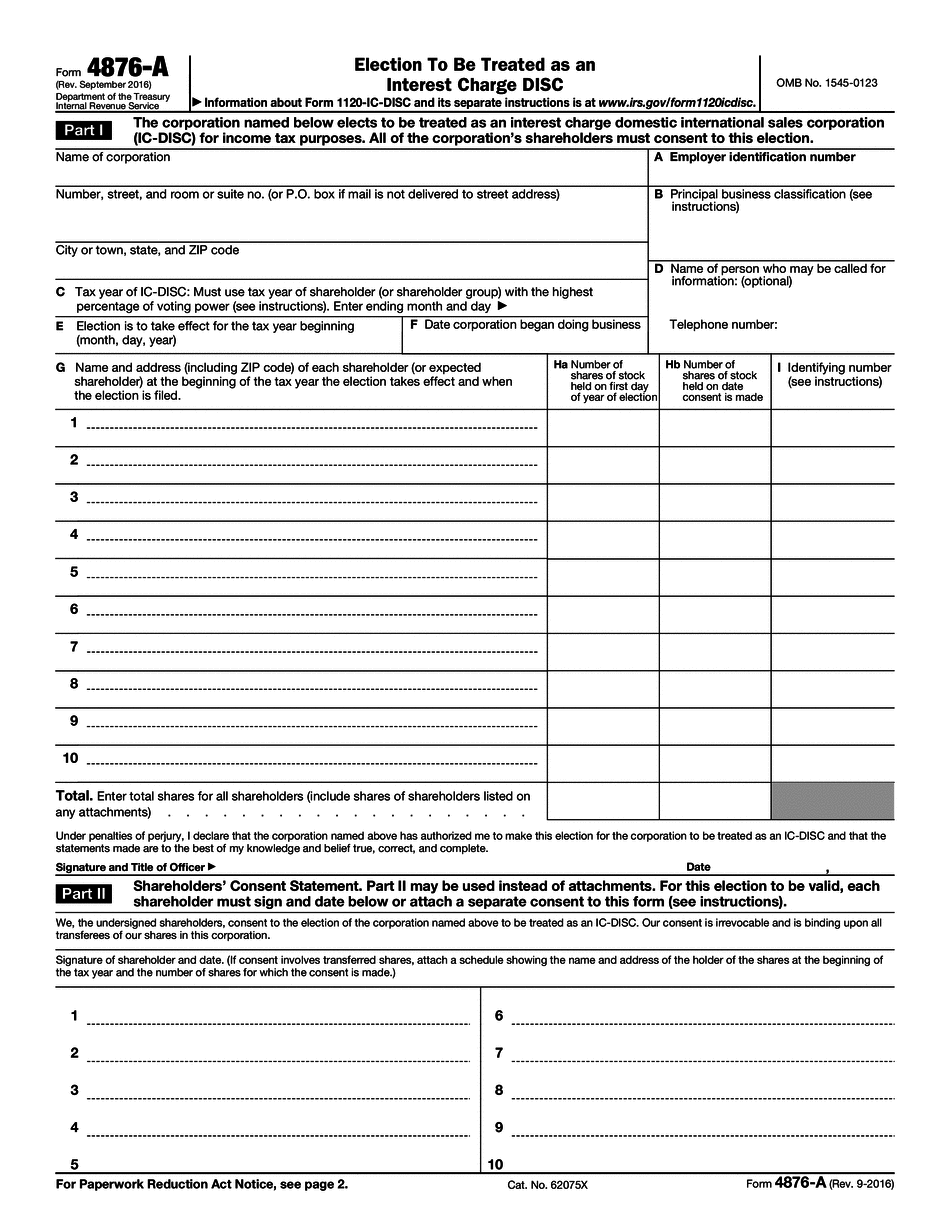

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4876-A Texas Collin, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4876-A Texas Collin?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4876-A Texas Collin aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4876-A Texas Collin from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.