Award-winning PDF software

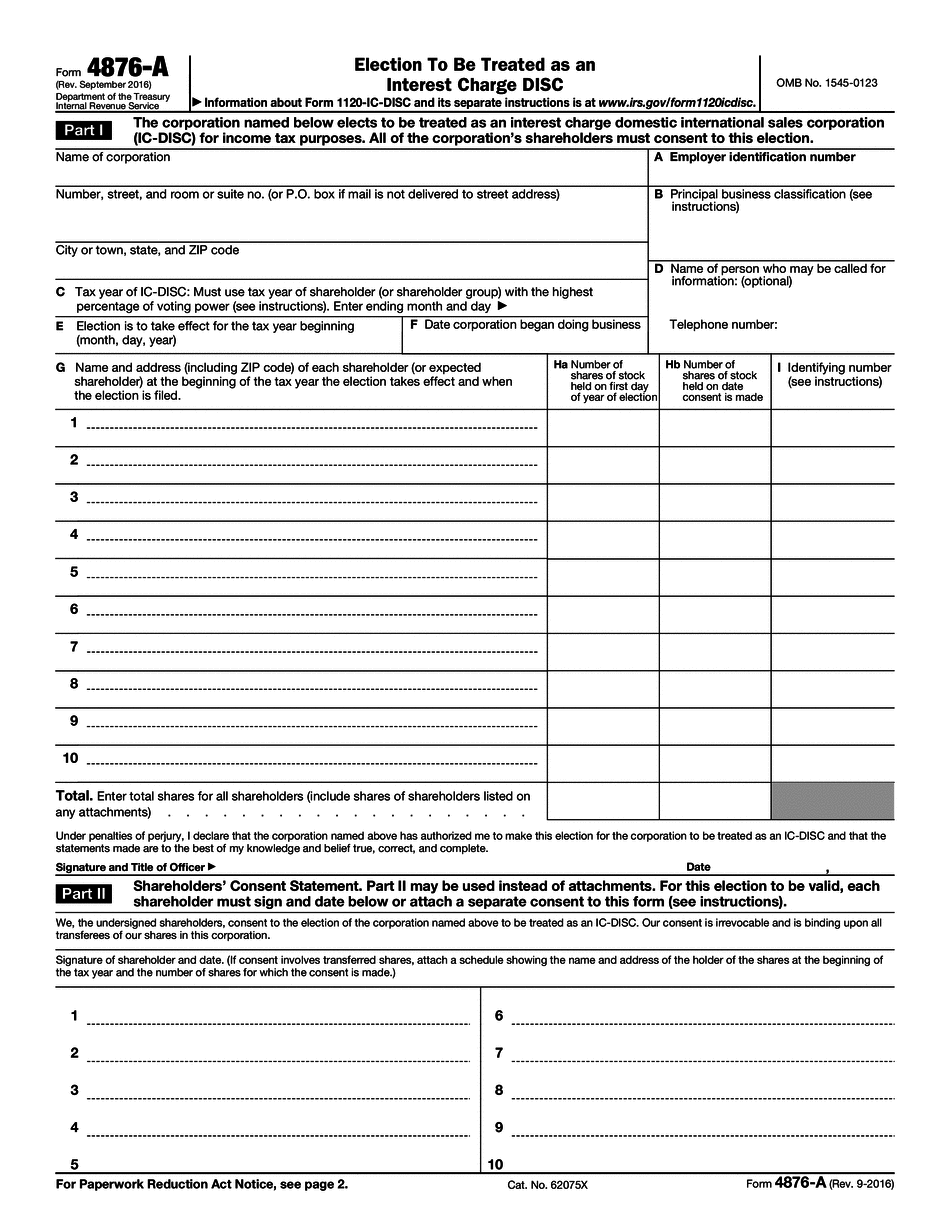

Form 4876-A California Alameda: What You Should Know

It also contains a detailed examination of the most recent annual property assessment and property tax issue for Alameda County. The report may be consulted at the Office of the Assessor. TABLE OF CONTENTS I. GENERAL INFORMATION II. COMMON FACTS The following summarizes the most important general facts about property assessments and property taxes in Alameda County. It is provided for the convenience of residents and business persons. II.1.2.2(a) Assessed Value and Property Tax Payments. This portion of the report contains information regarding the general properties which are assessed annually. It includes a description of the current assessed values, the property tax payment structure, and certain types of properties which bear assessment values and property tax payments. This information can be used by the taxpaying public in general to assess its properties and compare the assessed valuation and taxes paid to other properties that may be assessed separately. The report also includes information on certain special districts. II.1.2.2(b) Property Tax Structure. This portion of the report provides information regarding the different property tax systems of Alameda County. To assist residents and property owners, this report lists a description of each of the county's property tax jurisdictions and sets forth the methods used by the county to assess and collect property tax on property subject to assessment. II.1.2.2 Assessed Value Changes. This section of the report provides historical information related to each property that has been assessed. This includes the following information: the name of the taxpayer, the taxable year for which the property tax is being assessed, the property classification in each taxation year, and the amount of assessment and tax paid for that property. It also includes information on the most recent assessments for the property and the most recent tax payment for the property, both prior and subsequent taxation years. The total amount of property tax paid for all properties is included in the most recent property tax issue for that property; the tax rates, amounts of property tax, and amounts from each of the property tax systems used to tax the property for the most recent taxation year are summarized in this report. II.1.2.2(d) Current Tax Rates. Property taxes in general, and property taxes paid by nonresidents of California who elect to be treated as residents for all taxable years, are assessed according to a weighted average of the tax rates for that jurisdiction. Beginning in 2013, Alameda County has adopted a system of “local option” tax rates.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4876-A California Alameda, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4876-A California Alameda?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4876-A California Alameda aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4876-A California Alameda from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.