Award-winning PDF software

Greensboro North Carolina online Form 4876-A: What You Should Know

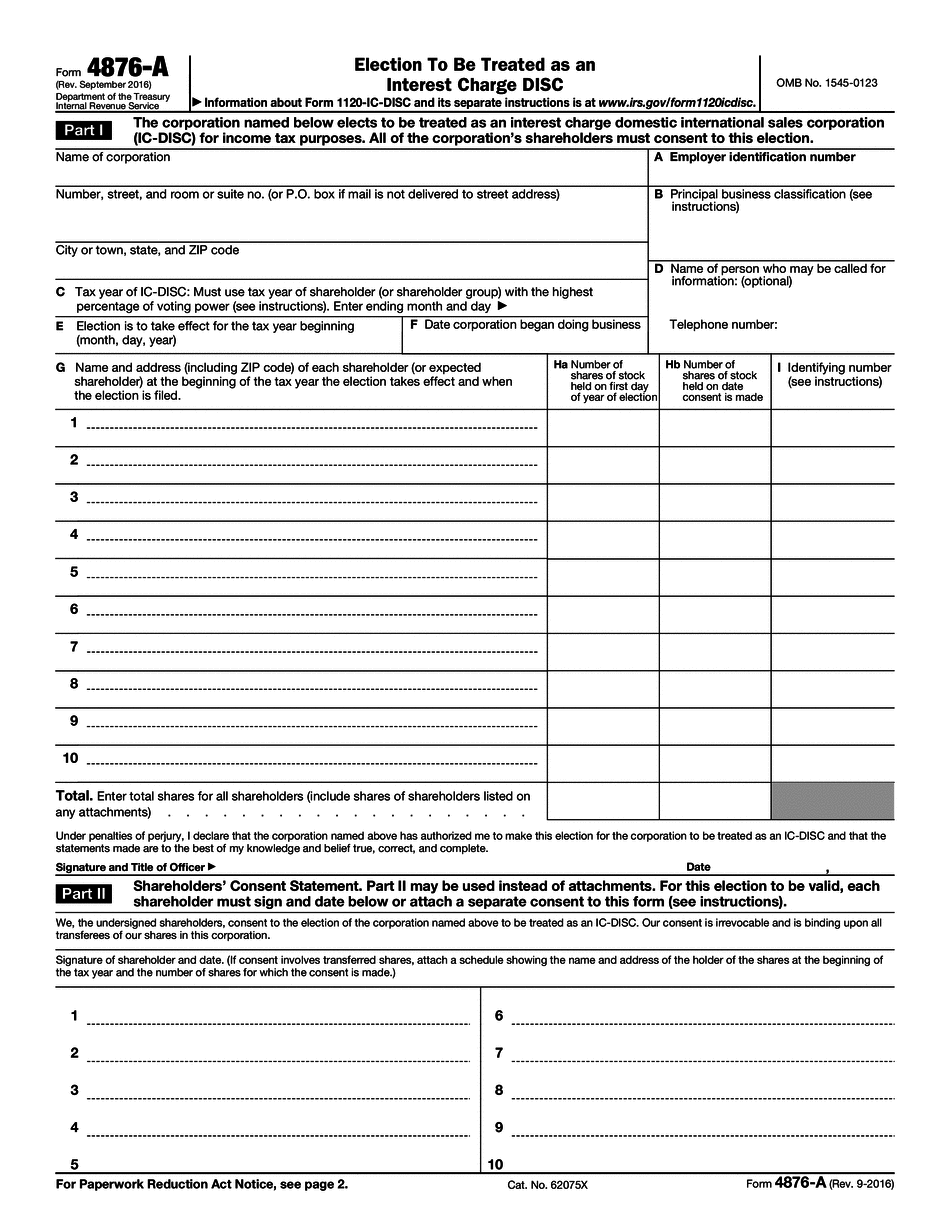

Aug 9, 2025 — City of Anchorage. City Hall Annex, Room 617. 507 East Second Street, Anchorage, AK 96607 Sept 1, 2025 — City Auditor and City Manager, Community Safety and Development Division. Room 4A. 527 East Second Avenue, Anchorage, AK 96609 Dec 16, 2025 — City Manager and City Auditor, Community Safety and Development Division. Room 5A. 527 East Second Avenue, Anchorage, AK 96609. Form 4876-A (Rev. September 2016) — IRS A corporation files Form 4876-A to declare independence as an entity separate from, and independent of, its parent corporation and file a separate form 1065 which is filed with Alaska. Alaska has no rules with regard to entities. The only rule that the corporation must follow is that no employee of the corporation (individual, trustee, director, partner) may own more of it than 30,000. Filing requirements are as follows. An individual shareholder must file the Schedule of Authorized Shares (Form 1065) if it owns no more than 30,000 of the corporation's common stock and no more than 50 of any class of securities in the corporation. An individual shareholder must report all other shareholders on a separate Schedule 88-G. A partnership or trust, on the other hand, must file the Form 88-G only for each individual who owns less than 30,000 of the partnership or trust's common stock or less than 50 of any class of securities. A corporation whose only shareholders are individual persons or persons who hold more than 5,000 of the partnership or trust's common stock or more than 5,000 of any class of securities in the corporation generally must file a Form 1065. If the corporation has more than ten shareholders, it may file Form 1065 for any shareholder who is an individual. It must file a Form 1065 reporting any shareholder who owns more than 5,000 worth of the corporation's common stock. If the corporation has more than 20 shareholders, it must file Form 1065 for anyone who owns more than 5,000 worth of the corporation's common stock, regardless of whether a shareholder is an individual. Alaska has no specific rules for corporations. The only rule of an Alaska corporation is that no owner of the corporation (individual or corporate entity) may own more of it than 30,000, a figure which does not include the value of the individual shareholders' stock.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Greensboro North Carolina online Form 4876-A, keep away from glitches and furnish it inside a timely method:

How to complete a Greensboro North Carolina online Form 4876-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Greensboro North Carolina online Form 4876-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Greensboro North Carolina online Form 4876-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.