Award-winning PDF software

Form 4876-A for Surprise Arizona: What You Should Know

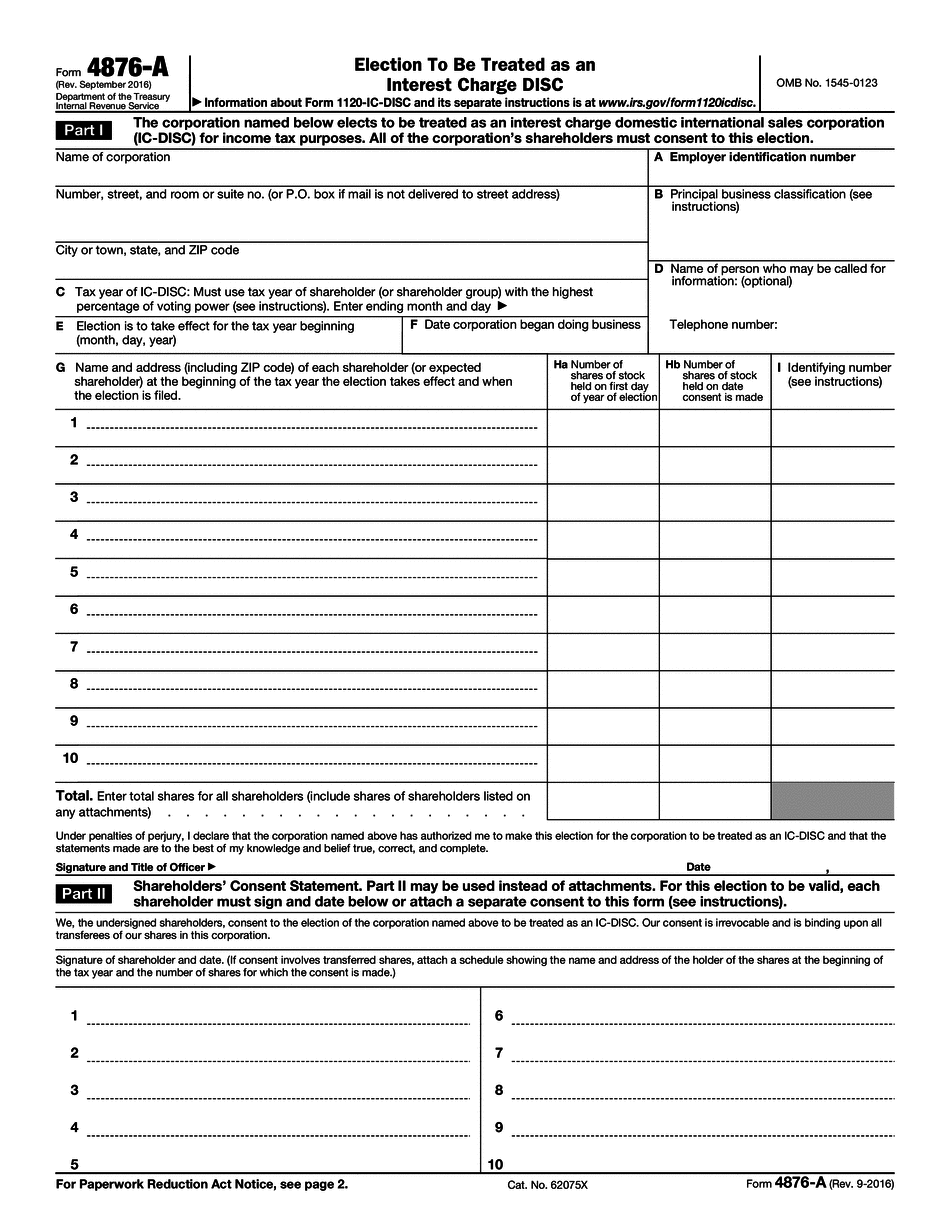

To be eligible to file an election to be treated as an interest charge DISC the corporation must file with the service center it will be filing its return for the taxable year under the same name (as listed on the front page of the Form 4876) for which it would otherwise be required to file. The voting rights act has been amended since this form was filed to reflect this change. Please refer to section 1.002 of this form for additional information and Form 4876-B, Election to be Treated as an Interest Charge DISC, which must be received by the service center before the due date of the return of such corporation for the taxable year. Section 1.002 of this form states: An election to be treated as an interest charge DISC has the same meaning and effect as an election under section 4(b)(2)(A) or under section 16(a). Thus, if you have elected to be treated as an interest charge DISC under section 4(b)(2)(A) or section 16(a), you may elect to be treated as such an interest charge DISC for any taxable year that you are not treated as a DISC for that taxable year by another section. Election may be withdrawn and made effective if it fails to state that you are in violation of law or does not appear to comply with the requirements for an election under this section. Electronic Filing Required To Receive Report Oct 24, 2025 — ARIZONA, Subjurisdiction: ; County: MARICOPA ; ACTION Date: 10/23/2002 ; Polling place (Changed) ; Submission Number 26 CFR Part 837. (a) Except as provided in paragraph (a)(1) of this section, no corporation shall file the return and no elector shall vote on, nor shall anything be done with respect to any election for nomination or election of any person as a member of either house of the legislature, unless for each corporation in which any electors are allowed to vote in elections for members of the legislature, and for each elector in each such corporation, such corporation shall file its quarterly financial statements with the Secretary of State electronically in accordance with Regulation 1.936-1 and the regulations of this chapter.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4876-A for Surprise Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4876-A for Surprise Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4876-A for Surprise Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4876-A for Surprise Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.