Award-winning PDF software

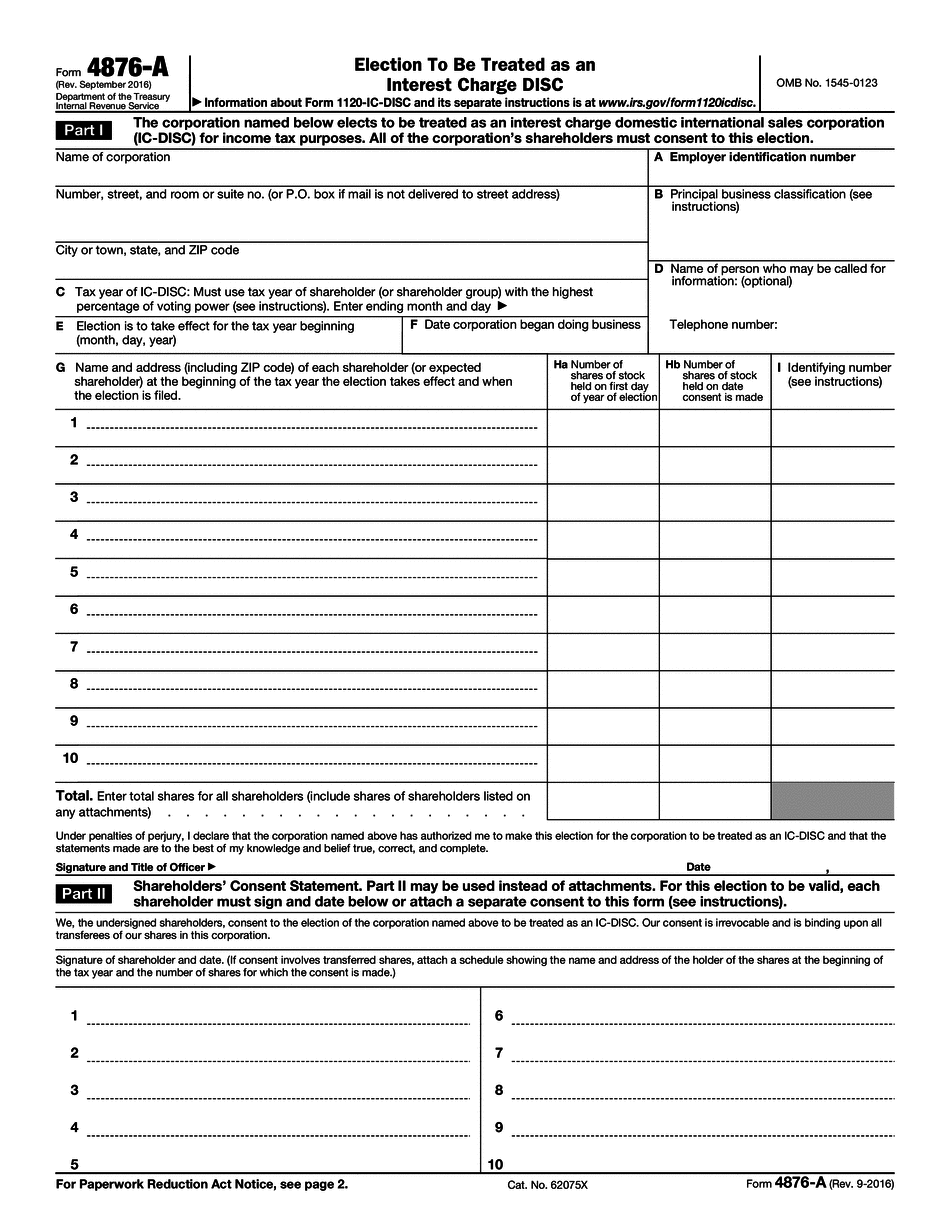

Form 4876-A Elizabeth New Jersey: What You Should Know

Sep 20, 2025 — Summary of S.4876 — 117th Congress (2): A bill to repeal the prohibition on the trafficking and manufacture of The Official Website for The State of New Jersey The Official Website for The State of New Jersey The Source for New Jersey's Property Tax Information The information on this web page is subject to change at any time without notice. This is intended as a guide only, and it should not be construed as legal or other professional advice. The information on your tax return and on this web page is subject to change at any time without notice. The State of New Jersey taxes real estate (lots of it) and motor vehicles (including boats) on a tax basis. These taxes generally increase every year. These increases are not subject to “rollover”. This means that you will receive a lower tax bill should you claim one the following year. For more than one year, your taxable income will be based on the last year's tax return. If you have not elected to receive a tax refund, you may be entitled to a refund of your tax liability as long as you have not claimed any credits. New Jersey uses the dollar amount of real property taxes (as well as vehicle registration fees) to determine your real property taxable valuation. You may be assessed more or less than you are paying for your home or car. New Jersey's income tax laws (Sections 5-3-7, 5-3-7A, and 6-4-1) allow a taxpayer, to the extent that his or her gross income from sources within New Jersey exceeds 100,000, to elect to use the federal alternative minimum tax (AMT) in computing his/her taxable income instead of the state taxes imposed by the Internal Revenue Code on income derived from sources within New Jersey. An individual can elect any of the three options: (1) AMT, (2) a portion of the portion of AMT, or (3) a portion of a portion of the portion of AMT. A taxpayer who does not elect the AMT option but is subject to the state income tax (Section 7201(a)(1) and 7201(b)(1)), must compute and keep separate records for the year in which the election is made. The taxpayer will be subject to both New Jersey income tax and the state tax imposed by the Internal Revenue Code on his/her income, regardless of which tax is selected.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 4876-A Elizabeth New Jersey, keep away from glitches and furnish it inside a timely method:

How to complete a Form 4876-A Elizabeth New Jersey?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 4876-A Elizabeth New Jersey aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 4876-A Elizabeth New Jersey from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.