Award-winning PDF software

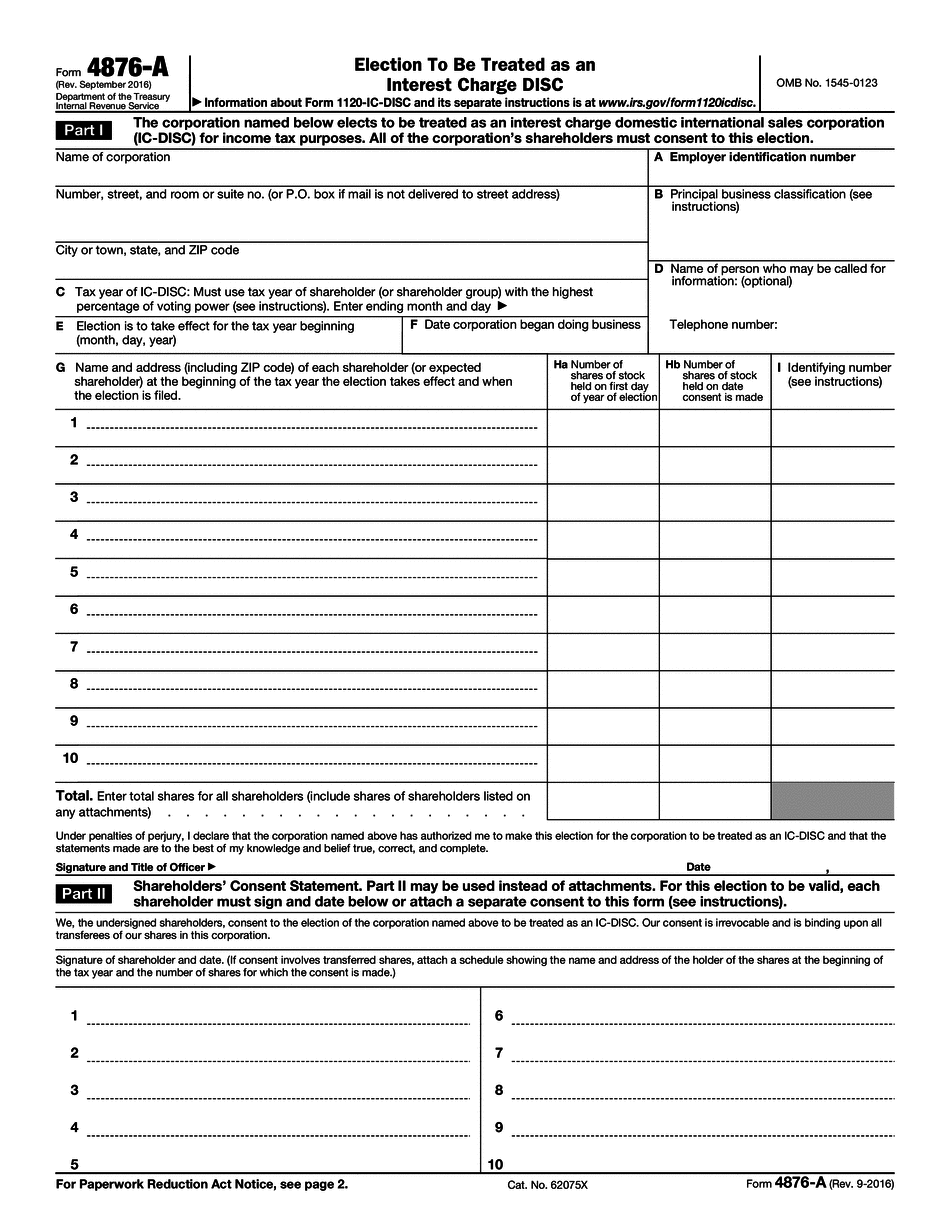

About form 4876-a, election to be treated as an interest charge

The following are some considerations to determine whether you will be treated as an IC-DISC: 1) IC-DISC is limited to IC-DISC status only if it receives foreign income to the extent of more than 50,000 in the calendar year (or, in the case of a domestic international sales corporation, 50,000 in the aggregate throughout the calendar year). 2) If there was no determination of foreign income by the foreign tax credit carry back, and if you qualify for a deduction for foreign taxes paid, then the income would be taxed as a regular income tax for purposes of determining the amount of any foreign income tax deduction. However, if you are a stockholder, it will be taxed as capital gain under section 951 if it exceeds 100,000, and you can claim a foreign tax credit for any excess on Form 4570 in the year in which it is received..

form 4876-a (rev. september 2016) - internal revenue service

Becomes a business for tax purposes.” The IRS then adds that since “if no election is taken,” then the C corporation becomes a corporation, meaning the corporate form number remains on the C corporation's Form 4797. An additional statement from IRS's Corporate Taxpayer Advocate to the effect that “A corporation filing Form 4797 must recognize that the IC-DISC election can be made before the date the form is filed (usually April 15, 2013) to ensure your corporation's current tax liability remains the same to the IRS regardless of whether the company files Form 4797 to change its status [to become an IC-DISC).

26 cfr § 1.992-2 - election to be treated as a disc. - legal

I) files a Form 4876 for the entity with which the corporation has a relationship that is more than a merely business relationship. (ii) files a Form 4876 and certifies that no corporation that is not an estate (within the meaning of § 1346 of this Chapter) or trust is established under the same name as the corporation filing the Form 4876; and (iii) files a separate Form 4876 for each of the shareholders that has an interest in the same class or series as the relationship. (5) Election of single trustee. For purposes of Part IV, if an electing S corporation elects that the shareholder trustee will be considered the sole trustee for purposes of the provisions of the Act that are applicable solely to the stock of the corporation (except to the extent specifically provided by applicable provisions of § (g)), the corporation file and serve a copy of.

Proposed collection; comment request for form 4876-a - federal

If they have elected, then we need to look at how the corporation, shareholders and shareholders' elect to use the corporation to report income. What the corporations may do, or be required to do, when there are two or more tax rates is an issue we will cover again later in the series. Form 496A — Domestic International Sales Form 496A — Domestic International Sales This Form 496A provides shareholders information for the year ending in June of any domestic corporation's taxable income from selling sales of foreign countries or foreign assets sold and the amounts, if any, paid to third parties for the sale of such assets. This form is issued to shareholders who elect, and we discuss how they may do so in the next section. This Form 496A form requires you to provide the information you have previously reported on Form 4562. You could elect under section 83(b) of the.

Form 4876-a election to be treated as an interest charge disc

Free version: Limited to 10 forms. No time limits or login required. Cost: 29 per week. Type: Work, Study, Reading Free version: Open Educational Resources. Free for anyone who provides an open access repository. Includes PDF and Microsoft Office. Cost: per year. Type: Practice with a teacher and get an interactive guide to using the forms Free version: Free for anyone. Cost: Free Type: Practice with a teacher or tutor and get an interactive guide to using the forms Free version: Free for anyone. Cost: Free Type: Practice with a professor or tutor and get an interactive guide to using the forms Free version: Free for anyone. Cost: Free Type: Practice with a student, and get a customized lesson plan and customized assessment cards for each unit in your course. Free version: Free for everyone. Cost: Free Type: Practice with a student, and get the ability to create individual lessons for students, or take advantage of the online course platform. Includes a lesson planning tool.